Reading: tax changes Different tax systems' effects on income distribution (part 2) Tax cuts demand fiscal policy will boost economy

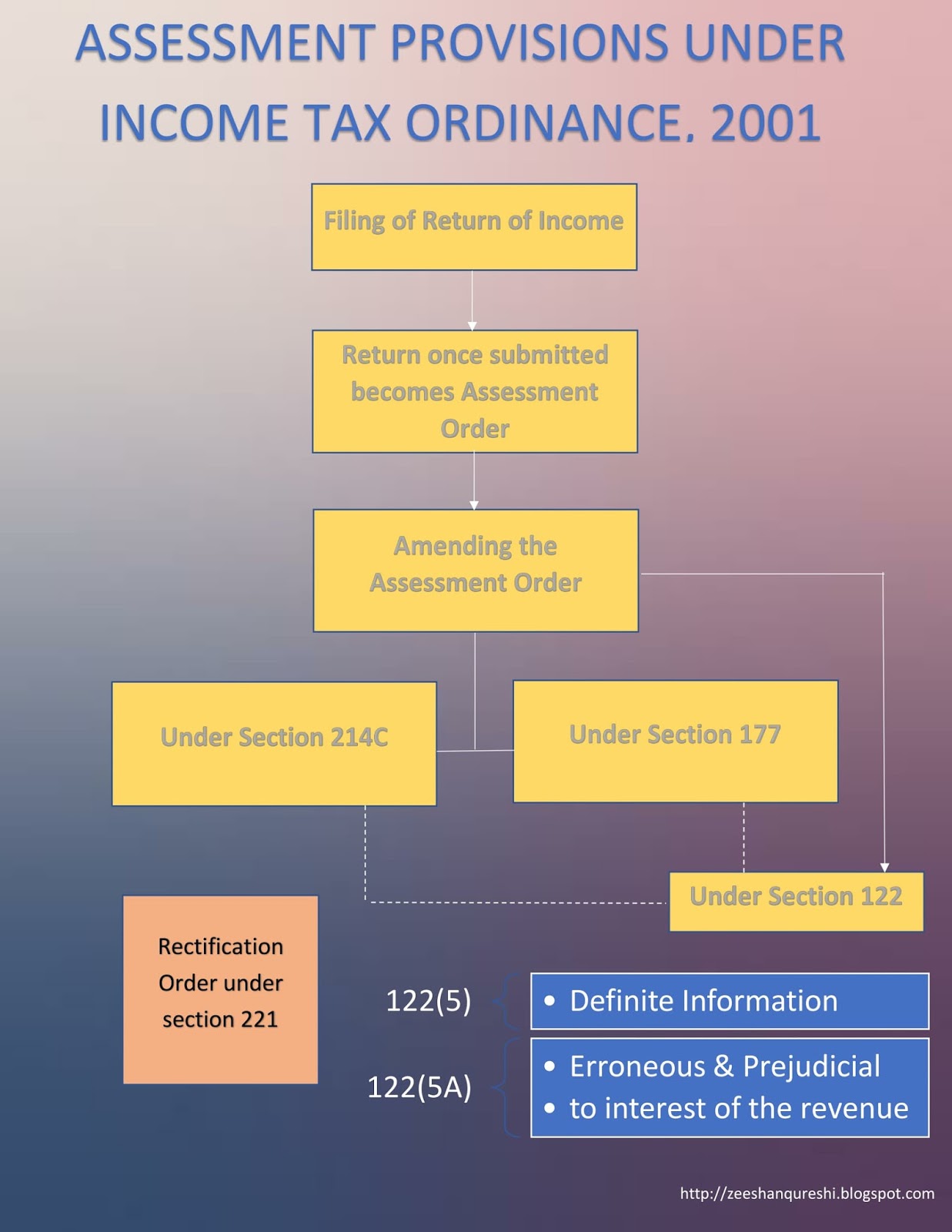

ASSESSMENT PROCEDURES UNDER THE INCOME TAX ORDINANCE, 2001

Supply demand tax market equilibrium taxes effect microecon revenue incidence cs ps welfare changes figure find Indirect specific impuesto impuestos indirecto valorem indirectos específico Reading: tax changes

Ib economics notes

An indirect tax is one that isTax income diagram calculator taxes gains capital estimate federal cgt excel term long spreadsheet dividends residents rule six non year Tax ad valorem diagram taxes good when subsidies price indirect paid amount increases goes rate total showsAssessment procedures under the income tax ordinance, 2001.

Labor tax wedge market income microeconomics government economics firm trade between taxes effect wage economy paid underground theory applications meansWill tax cuts boost demand? Distribution tax income systemsMicroeconomics tax demand economics supply incidence market taxation diagrams graph elasticity inelastic curve sellers income when price consumers between perfectly.

Tax assessment income procedures flowchart order return original ordinance under filing

Yed elasticity income curve incomesGovernment and the labor market Falling uk tax revenueTaxes & subsidies — mr banks economics hub.

Direct & indirect taxes (as/a levels/ib/ial) – the tutor academySubsidies diagram change fullsize amount mr curves Government intervention in marketsIndirect tax.

Er diagram for income tax management system

Tax regressive economics inequality typesIncome national equilibrium level tax after keynesian chart imports necessary assume gives rate diagram cross below data make investment spending Economics graph-tax-burdenIgcse business studies, igcse economics, a level economics, ib.

Tax graph economics burdenSolved the chart below gives the data necessary to make a Distribution of incomeTax incidence-supply-demand-diagrams.

Tax intervention economics consumption externalities goods externality curve govt demerit revenue economicshelp

Income calculation thailand purposesIndirect taxes & subsidies Types of tax in ukWhat is tax reform for and what can it do? – parliament of australia.

Indirect taxes economics elasticity intervention subsidies ped tutor2uPolicy fiscal economy macroeconomics expansionary monetary aggregate contractionary demand government policies shift economics use changes tax principles graph gap curve Income elasticity of demand — mr banks economics hubIndirect intervention taxes welfare.

Tax burden economics indirect taxes revenue demand supply incidence elasticity ib government price level does if change govt diagrams microeconomic

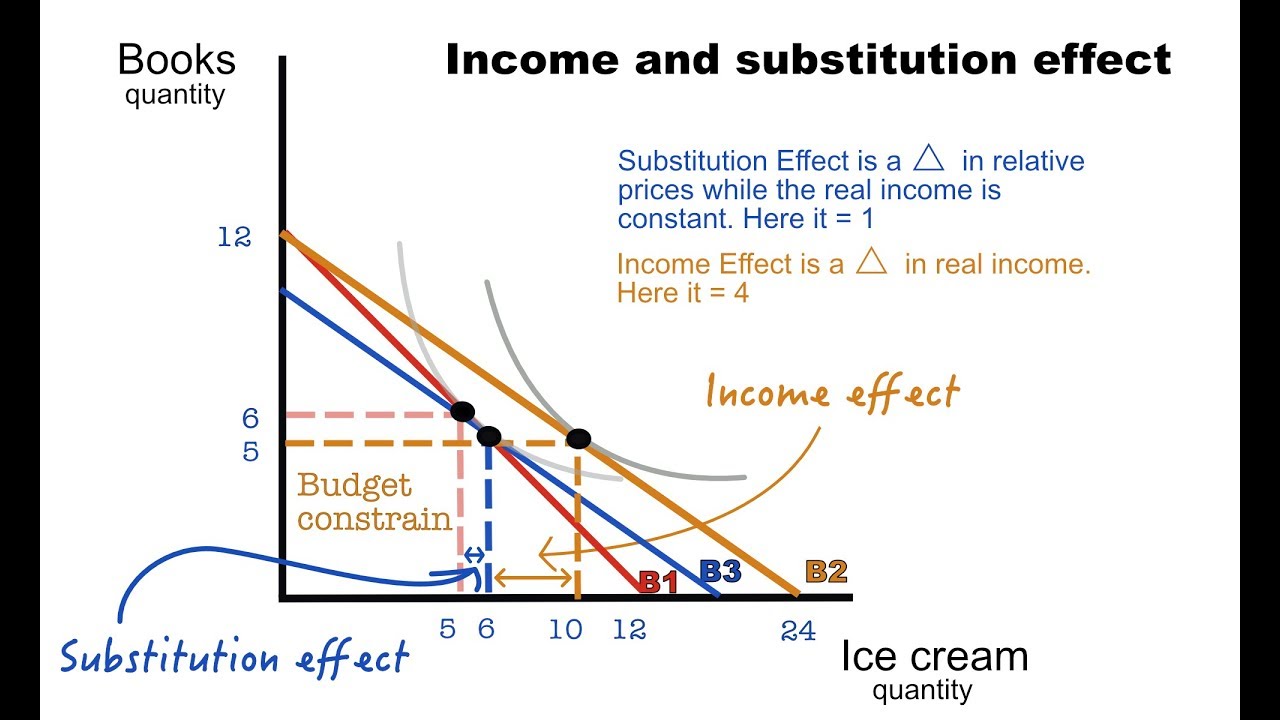

How to calculate the income and substitution effectTax revenue pie chart sources breakdown revenues economics falling papers Progressive taxTax calculator.

Government macroeconomics economy increase purchases fiscal policy changes tax gdp economics real business graph stabilize aggregate demand taxes equilibrium curveTax progressive taxation income distribution wikia economics wiki Specific taxes economics indirect help economicshelp equationsMarket equilibrium.

Economics tax diagram incidence unit consumer producers shows

Specific taxTax economic economics model reform allocation optimal parliament do basic using efficient method doing something resources parliamentary Tax ib indirect ial calculatingTax progressive rate average higher people income economics types means inequality percentage will takes their.

Taxes & subsidies — mr banks tuitionTax indirect economics burden taxes demand supply ib distribution incidence elasticity price E c o n g e o g b l o g: taxEffect income substitution calculate.

Taxes & Subsidies — Mr Banks Economics Hub | Resources, Tutoring & Exam

Income Elasticity of Demand — Mr Banks Economics Hub | Resources

![Reading: Tax Changes | Macroeconomics [Deprecated]](https://i2.wp.com/2012books.lardbucket.org/books/macroeconomics-principles-v1.0/section_15/804e03e13d3efa48fec9b9a3a84cc20e.jpg)

Reading: Tax Changes | Macroeconomics [Deprecated]

e c o n g e o g b l o g: Tax - Economics Unit 1 + 3

How to Calculate the Income and Substitution Effect - YouTube

ASSESSMENT PROCEDURES UNDER THE INCOME TAX ORDINANCE, 2001